http://news.goldseek.com/GoldSeek/1257517722.php

http://www.longwavegroup.com/

Interview With Ian Gordon

TRACE: Great. To start off with the latest news, why do you think that the gold price is taking this rapid jump of about of $60 per ounce over the last week.

IAN: I have never really that concerned about the “machinations” at work. I am extremely bullish on the gold price basically because I think the world is falling into the deflationary depression of the 1930’s and because of that I do not really worry about what is happening in the short or intermediate term. I think we are going to see much higher prices anyway. But I guess if I was to give you an answer I suspect it might be that India is buying the International Monetary Fund gold.

TRACE: 200 tons!. Usually that is trotted out by the gold cartel as “Oh, we are going to sell the IMF Gold and the price will go down. But in this case, India bought about half of what was available. I suppose that China is probably waiting in the wings to buy the remaining amount. Why do you think it is that India is willing to allocate this small percentage of their foreign reserves to purchase the IMF’s gold.

IAN: Well, I think that gold as money is going to shift to the wealthy countries and it is shifting out of the United States because the IMF is essentially run by the United States and is moving to the wealthy countries of the east. And that is where the wealth of the world is moving as well. I think that for a country like India it has to put more of its reserves and it already has cause it only has a minuscule amount into gold because other reserves are in the dollar and you know what is been happening to that. Basically anyone invested in the dollar is being badly hurt.

TRACE: Exactly. I could not agree with you more on these points. Now with the Long Wave Group you focus on long-term waves and particularly on the Kondratieff Winter. And actually we met at a Cambridge House Investment Conference and I think we were both presenting there. And I think we have a pretty similar viewpoint on what is happening. “What is the Kondratieff Winter and the theory that under girds a lot of your work.

IAN: Okay my work is developed around Kondratieff Cycle that was promulgated by Nikolai Kondratieff, a Russian economist in the mid-1920’s. It is a long economic cycle and he based his theory on prices, on the movement of trade, on money movements and inflation and so on. And he came up with this idea that capitalism really underwent this long cycle of expansion and contraction. That the cycle lasted about 60 years, so first half of the cycle is really the expansion phase, and the second half is the contraction phase, and the last quarter of that contraction phase essentially is the depression- a deflationary depression stage in the cycle.

TRACE: Now, just an interesting tangent what ever happened to Mr. Kondratieff?

IAN: Well, Stalin sent him to gulag and he died in about 1938 in the Gulag. I mean some people had it that he was executed but what I read was that he actually just died in the gulag.

TRACE: It would be funny if it were not so sad that we had these political leaders, really just criminal gangs that strut around in their costumes, and yet when somebody comes along and does have a theory, like Galileo for example, and it explains how the world really works then the common response to that is to shove them in the gulag. And Mister Kondratieff was not any different than a lot of the very insightful thinkers that we have seen over the last century.

I noticed from your report that I read, “All That Glitters Is Gold” that you say:

The velocity of money will essentially come to a standstill … In deflation, as in the 1930s, those few people with money curtail their spending in the knowledge that prices will be lower tomorrow.

Could you please expound on that?

IAN: Most people today are basing their assumptions on the Federal Reserve printing and assuming that that monetary printing is going to lead to inflation. And most of the bullish gold analysts are bullish because they see inflation coming in to the economy. We are of the opposite view. We believe that we are going to have deflation and in fact massive deflation in the economy. And to have inflation you have to increase the money supply. But to have an increase in the money supply the money has to transfer to the people who want to spend it. And to spend it as fast as you can because what they see ahead of them is just rising prices so they buy today rather than pay the high price tomorrow.

What happens in deflation is people do not spend but instead hoard money because they see lower prices tomorrow and they would rather wait for the lower prices. A deflationary environment always sort of happens when the economy is really really bad. And we are going into the Kondratieff Winter or deflationary depression stage and people are scared. Because they are scared they are not going to be spending money but the Federal Reserve and the central banks around the world want them to do. They are going to be hoarding the money which we see with the banks. The banks are not lending money out and they are hoarding it to improve their capital base. So we do not get the fast movement of money in this kind of environment and therefore the velocity of money slows tremendously.

TRACE: And actually I think I have used the term “FROZEN”. But to take the other side of the argument, which I will do here, is not all of the these bank reserves just pent-up demand that will is like flood waiting to happen as soon as the dam bursts. Is not that not the argument of the inflationists. As soon as all these bank reserves finally burst through the dam and they begin lending again then we are going to have tremendous inflation and gold is sensing this future inflation and that is the reason it is rising. How do you respond to that type of argument?

IAN: Well, we have only just begun the real payback period. You know the whole purpose of the Kondratieff Winter or deflationary depression part of the cycle is the washing out of the debt has been built up throughout the cycle. And our present cycle started in 1949 but the main build up of debt occurs in what I call the autumn of the cycle.

And the autumn started in 1982 and that is where the banks really started to make money available to consumers and corporations so there was a huge amount of borrowing that goes on starting in 1982 but it really reached its peak essentially in 2007. And that big borrowing was lent to people who will never have the ability to pay it back. And we can see it in the housing crisis that is now going on in the United States and which we will see go through it in Canada even though most Canadians have believed that will not.

When that happens, all that debt starts to come out of the system. So that is money coming out of the system. And so the banks have been hit hard once on the sub-prime mortgage debacle. They are going to get hit hard again on other kinds of debt like commercial real estate. We are already seeing credit card debt starting to hurt some. So there is a massive amount of debt that is going to have to be taken out of the system.

You look at the United States and there is about $58 trillion of government debt. We have abut $44 trillion of consumer, corporate and financial debt. And about half of that debt is going to be washed out in the winter. I thought of conservatively estimated that it will be about $22 trillion but I suspect it is going to be more.

But $22 trillion, the Federal Reserve does not have the power to print that kind of money so that even if they did print $22T then we would simply be at the same place we are now. We would not have really increased the money supply. Well that is really what is going to happen is that were going to have a massive decrease in the money supply and the amount of deflation like we did in the 1930’s because the debt problems are the same. It was not as bad as then as it is today. And in fact, back in the early 1930’s we had a 30% deflation occurring in the United States. And I see a similar kind of situation happening this time.

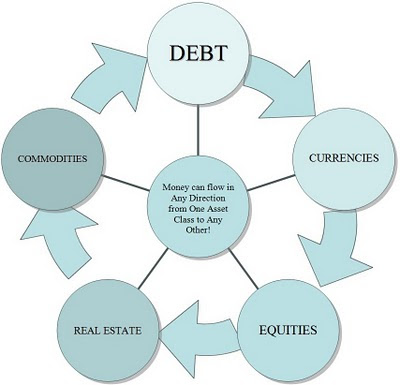

TRACE: Now, this is an interesting issue that I address right off the bat in my book The Great Credit Contraction. And it is, what is money? And so I actually like to distinguish money from currency. Currency being the tool or instrument that we use on our ordinary daily transactions. And currency can either be money, money substitutes or an illusion.

Money has to be a tangible assets such as gold, silver, platinum, etc., and a money substitute would be, say a gold certificate like we had in 1933. And an illusion is just some made up little green paper tickets or digits in some database such as Federal Reserve Notes or Canadian Dollars or whatever these fiat currencies are. Deflation under the Austrian school of economics definition is a decline in the money supply, or I would say the currency supply.

Could we have the illusions actually increase in supply to help support more of these gigantic inverse liquidity pyramid that is on top of it OR is your argument that even if the Federal Reserve tries to increase that the currency supply, which are illusions, that the capital will still go lower into something safer and more liquid, primarily gold, and that there is nothing they can do to stop this and therefore the evaporation of the liquidity pyramid because the earning capacity of the worldwide economy just is not substantive enough to support the service of all the debt.

IAN: We have all seen Exter’s inverse pyramid and I have a copy on my website. I know you have developed your own inverse liquidity pyramid and both have in common that at the bottom of the pyramid is gold. Gold is the ultimate currency that people have trusted. And that is really what we are already seeing with the move to gold. There is not any inflation. Yet, there has been a massive move to gold causing the gold price to close in on $1,100 per ounce. So people are buying gold and hoarding gold because they are fearful of what is transpiring.

TRACE: So we see for example the evaporation of auction rate securities, commerical mortgage backed securities or money marketsand those like cash instruments we are seeing people move into are either Treasury Bills or going a step further like the Indians and saying just give me two hundred tons of physical gold bars in my hand.

IAN: Exactly.

TRACE: Fear is definitely a powerful motivator. Now, I would like to tease out another one the quotes from that report you sent me:

Once the debt bubble is unwound, it is deflation in nature because it is painful and results in bankruptcies on both side of the ledger. Actually, it takes money out of the system and during our Kondratieff Winter, trillions of dollars of debt will be expunged.

Now we talked a little bit about the latter part but how about the former. When you talk about it resulting in bankruptcies on both sides of the ledger, what exactly do you mean?

IAN: I mean both the creditors and the debtors are going to be bankrupt. And we have already seen that. We have seen the creditors like the major banks both in the United Kingdom and in the United States being severely impeded by the credit bubble bursting. And we have seen the debtors being severely hurt as well. We have seen General Motors go bankrupt, Chrysler go bankrupt, and that is just the beginning because as they say, the next shoe has to drop. What we have seen really in this recovery phase in the markets and so on is very similar to the recovery phase that we saw 1929 to April 1930.

When the Federal Reserve of that time was really frightened by the crashing stock market and they pushed money into the banking system at a horrendous rate. According to Murray Rothbard in his book, America’s Great Depression, in one week the money supply was increased by 10%. And they brought down interests rates in 6 weeks from 6% to 3.5%.

That got the things going again and it got particularly the stock market going again so we got a recovering stock market from November 1929 to April 1930. And essentially 50% of the losses that occurred before that were recovered.

But the whole thing is that the debt that was underpinning the economy had not been paid back. So the real fragile state in the economy was the debt bubble. That had occurred throughout the 1920’s and it is in the same position today. So we have had a recovery in the stock market and I believe that recovery is over. And we are now going to the next level down in stocks much as as we did after April 1930.

TRACE: A few months ago I wrote about the coming market crash. We have actually already seen the Dow break down below 9 ounces of gold for the Dow, just recently. Now, back to this part about bankruptcies on both sides of the ledgers. I have written about bankrupting for profit and fair value lying standards with the mark-to-market FASB 157 affecting or being applied in keeping some of these zombie institutions alive.

IAN: Well, I think we are seeing it through sleight of hand. Basically, the values of the derivatives that they have on the books have been sort of pushed under the rug and hidden from view so that we are not really going to be a apprised on what the real situation is in the banks.

TRACE: And that perhaps is one of the reasons that we are seeing the bank reserves so high is that all the banks have an incentive to understate their liabilities under FASB 157 and yet at the same time overstate the assets but really the liabilities that one bank holds are an asset of another bank and therefore all the banks know that everybody is lying. And because of that therefore everybody is sitting on a lot of their capital in the form of bank reserves. Would you say that is a fair assessment?

IAN: I think so. Yes. Absolutely right on.

TRACE: OK. I got another quote I found very interesting in that report you sent out:

When that occurs as in 1873 and 1929, and now there is fear and panic. In all panics, there exists an instinctive will in all of us to survive and succor loved ones. Like always, the the paper money system collapsed and gold replaced it.

And so, in my book The Great Credit Contraction, I addressed the issue of Peak Oil. And so I was wondering exactly how bearish of the general worldwide economy are you? Obviously you are bullish about the precious metals but how bearish are you on the worldwide economy and perhaps the standard of living for example?

IAN: Well, I am very bearish. Again we go back to the 1930’s to use that as the measuring stick for what we might expect this time around. And in the 1930’s, the U.S. economy contracted by about 45%, or GDP drop by 45%. Now, I think its going be bigger this time because the debt level is significantly larger now than it was in 1929. But assume that 45% drop from $14T to $8T. So that is a huge, huge drop.

And it means that people are far poorer than they have ever been and an awfully lot of them are not going to be working. In the US in 1933 about 25% of the work force was unemployed and a much larger percentage of the workforce was employed in agriculture.

TRACE: It seems like you are not as bearish as some of people out there. For example, we have extremely complex systems. And when the Federal Reserve intervenes in determining both the money supply and the cost of money through interest rates it amounts to central economic planning. And that central economic planning may have worked when the economy was so simple with for example some thug coming in and saying well you can only sell your cow for a certain amount.

But now we have these hugely complex systems were we drill 5 miles into the ocean to extract oil. And then spray that oil onto our fields as herbicides, pesticides, and fertilizers to grow our food, and then we put the oil in trucks and to get the food into the supermarket. We have these hugely complex systems with central economic planning and that central economic planning is now failing. And there is a branch within the peak oil group that talks about die-off. What Obama is doing now is really trying to duplicate what President Roosevelt did.

President Obama and the Federal Reserve think that they can centrally plan the entire economy. Under Austrian Economics theory interest rates regulate production over time. And so, when we have the interest rates suppressed for the last 60 years we have produced a lot of things. Particularly the population of the world has increased tremendously.

Especially with peak oil and this complex systems that can fail do you see that we could perhaps have even a worse case scenario like some of those who talk about a die-off situation?

IAN: Well I do subscribe to the theory of peak oil. But again, I think the demand for oil is going to drop precipitously. Simply because no one’s gonna be working. Again if we use the idea that 45% of the U.S economy is going to be halted. That means essentially that the same kind of oil demand is the percentage dropping oil demand is also going to occur in the United States. And we are only picking on the United States because she has the largest economy in the world but we are all going be in be in the same boat.

So the whole world economy is going to drop by that kind of percentage.

TRACE: But not necessarily a precipitous enough drop that we could see 90% of the earth’s population washed away in this winter because of unsustainability?

IAN: Well, you are not going to see that because, as you know, there is a significant part of the world’s population who basically do not have anything anyway. If we go into Africa, or huge parts of China, India, etc. even though they are emerging nations they still have a large percentage of the population that are extremely poor.

So it is the wealthy nations that are really going to be hurt by this downturn and I think in particular, it is going to be WASP nations- United States, Canada, Australia and Great Britain, because that is probably where we saw biggest debt burden incurred.

TRACE: I agree. I doubt we will see a die-of situation. Thank you very much. If people want to learn more about your work and your theory, how can they do that?

IAN: They can visit my website Long Wave Group. Thank you very much Trace.